Divergence signals are indeed very rare and difficult to catch, and because of this, divergence is one of the most valuable reversal signals that Traders can catch. When a divergence signal is caught, Traders can hope to catch an early reversal of the trend, thereby bringing in huge profits.

PZ Divergence Lite – What is divergence and why is it so powerful?

Divergence is the phenomenon where the price and an oscillator move in opposite directions. For example, the price makes a lower low while the indicator makes a higher low, or the price makes a higher high while the indicator makes a lower high. Such opposite directions indicate a disagreement between the trend and the price momentum, as the oscillator shows the price momentum. When the uptrend occurs but the momentum decreases, or the downtrend occurs but the momentum increases, it indicates an upcoming reversal. The value of divergence lies in the fact that it provides us with early signals of upcoming reversals.

Some Traders do not like to use oscillators and instead use volume. For example, when the uptrend occurs but the trading volume decreases, it indicates a bearish divergence, and shows that a reversal is coming.

What is PZ Divergence Lite?

PZ Divergence Lite is a tool that combines many different oscillators that can generate reliable divergence signals. In particular, the highlight of this tool is that it automatically draws divergence signals on the chart, saving us time and effort.

PZ Divergence Lite is a remarkable tool with the use of some of the leading oscillators in the current indicator world. The oscillators that PZ Divergence Lite uses include:

- RSI (Relative Strength Index)

- MACD (including line and histogram)

- OSMA (Oscillator of Moving Average)

- AO (Awesome Oscillator).

These are all oscillators that have been recognized and widely used in trading for decades to hundreds of years.

PZ Divergence Lite with the combination of these oscillators helps create reliable divergence signals. When detecting divergence, this tool will automatically draw signals on the chart, helping users save time and effort in analysis.

However, it should be noted that the signal of PZ Divergence Lite can repaint (redraw) and will disappear after displaying if it detects the divergence is wrong. Therefore, when detecting a divergence signal, do not enter the order immediately but wait a few more candles to confirm the signal. This helps avoid fake signals and increase accuracy in trading decisions.

After installing PZ Divergence Lite into MT4, the tool will display on the chart and allow users to easily track divergence signals and manage transactions conveniently.

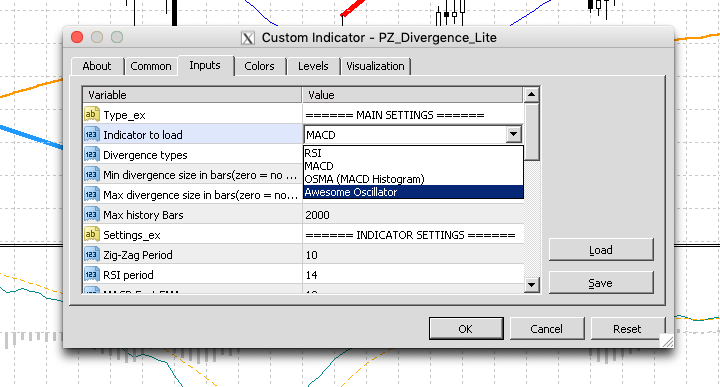

Parameters for PZ Divergence Lite

There are quite a few parameters of PZ Divergence Lite, but I want you to focus on this one: Indicator to load – where you choose the type of oscillator you want to use to display the divergence. There are 4 types as below

As for the rest, you can leave it at the default.

Applying PZ Divergence Lite to trading

When applying PZ Divergence Lite to trading, we can use divergence signals to identify potential reversal points in the current price trend. Here is an example of applying PZ Divergence Lite in trading:

Example: Bullish divergence between price and Momentum

- First, we need to select the Momentum oscillator in PZ Divergence Lite.

- Next, we observe the price chart and Momentum oscillator on the trading platform.

- If the price makes a lower low while the Momentum oscillator makes a higher low, we will have a bullish divergence signal. This shows that the current downtrend is likely to reverse into a new uptrend.

- When a bullish divergence signal is detected, we can consider entering a long position in the market. However, to ensure the accuracy of the signal, we should wait a few more candles to confirm the signal.

- In addition, we should also use other analysis tools and methods to confirm divergence signals and ensure trading risk is controlled.

Note that PZ Divergence Lite is just a supporting tool and does not guarantee 100% accurate signals. Therefore, their use needs to be combined with your trading knowledge and skills to make the final trading decision.

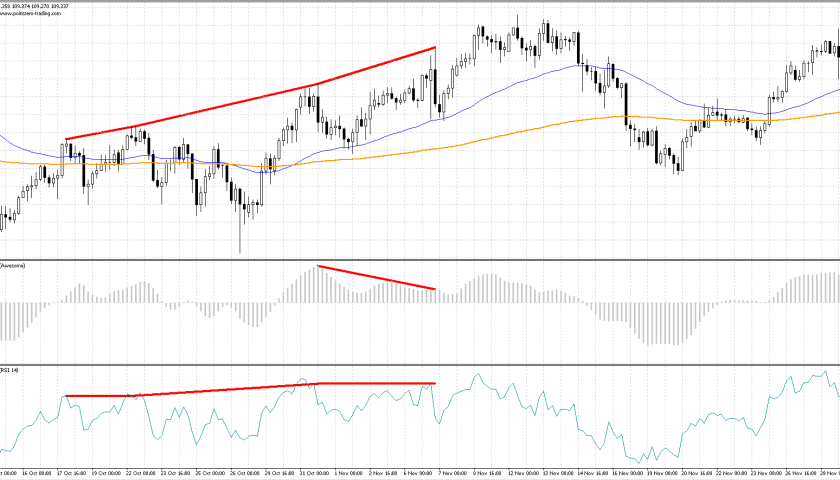

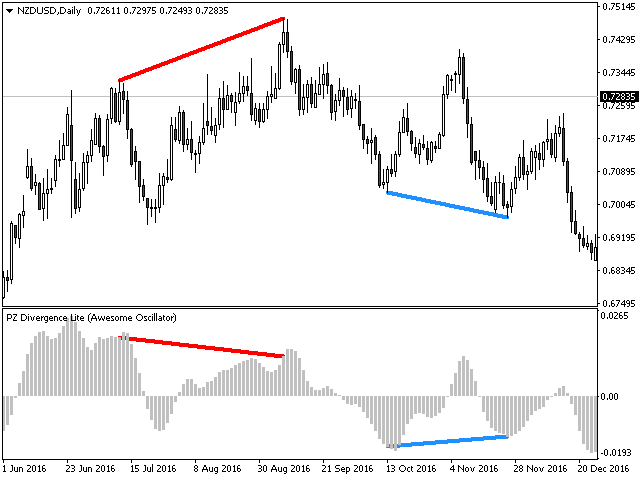

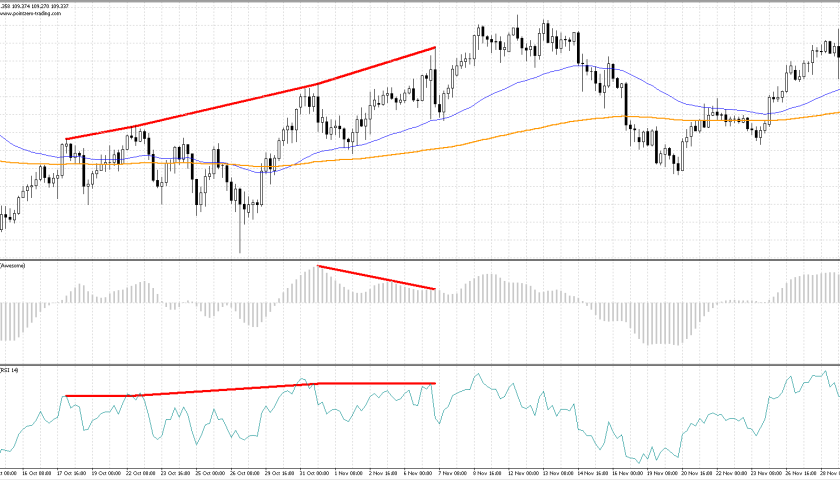

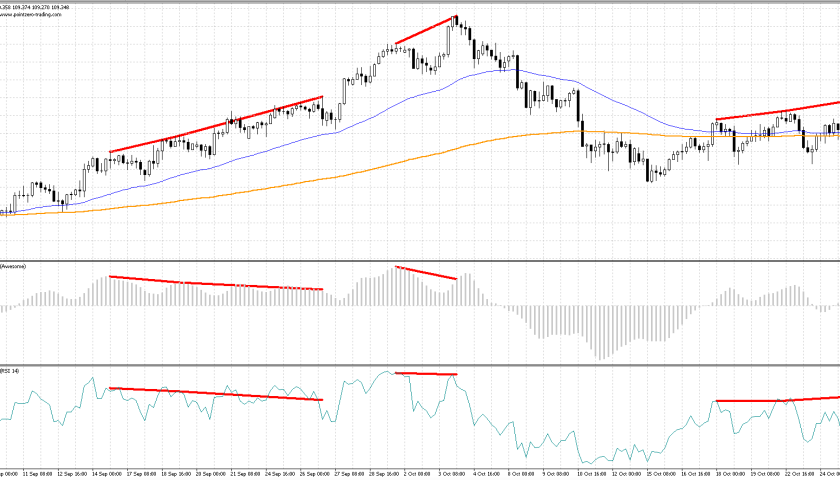

Bullish divergence between price and AO, price reversed strongly upwards:

Bearish and bullish divergence between price and AO, only the first bearish divergence signal is accurate:

Bearish and bullish divergence between price and AO, the first accurate price reversed:

Bearish divergence between price and RSI, highly likely that the price will reverse:

Bearish divergence between price and RSI, price reversed very nicely:

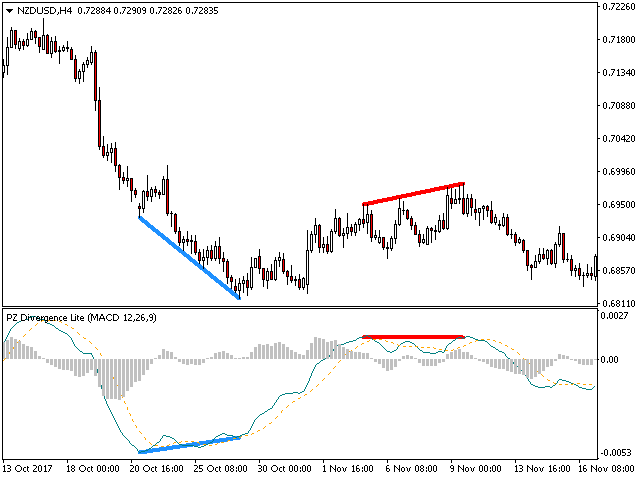

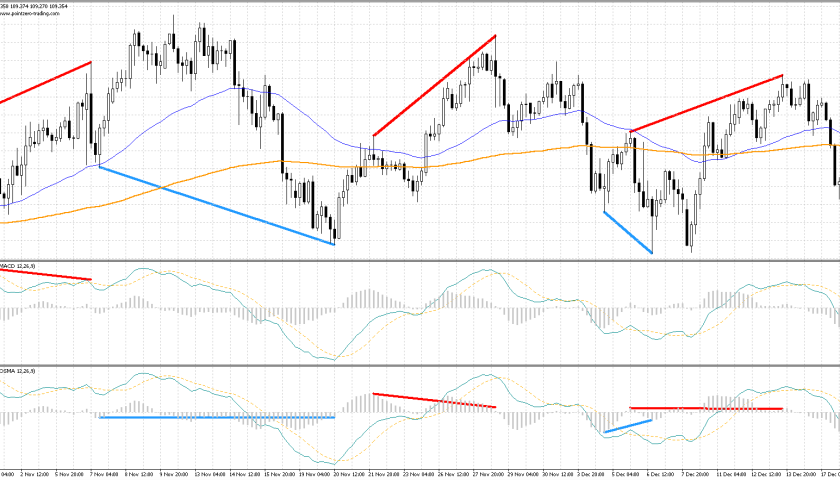

Bullish and bearish divergence between price and MACD, both are accurate signals:

The most reliable way to trade with divergence is to wait for the divergence to complete and prepare to trade the reversal. One method is to place sell stop or buy stop orders before the price reverses for the first time. However, this method may not take advantage of the power of PZ Divergence Lite.

We should remember that divergence is only a signal to prepare for a trend reversal, not a confirmation signal to enter an order against the trend. Catching the bottom or top is a dangerous game and is not recommended. Top Traders around the world all give similar advice.

Strategy combining both oscillators

Instead, a better way to trade divergence with PZ Divergence Lite is to combine both oscillators. For example, we can use AO and RSI. When a bearish divergence is detected, we will observe the reversal trend after the divergence on the chart.

However, to ensure accuracy, we need to wait until the trend has fully reversed before participating in the trade. This way, we can take advantage of the power of PZ Divergence Lite to identify potential reversal points and increase the likelihood of success in trading.

Note that in trading, using PZ Divergence Lite is only a part of the analysis and trading decision process. It is also important to note that combining other analysis tools and methods is also very important to comprehensively assess the market situation and make smart trading decisions.

Beautiful reversal after bearish divergence:

MACD and OSMA, PZ Divergence Lite detects most price reversals:

Below is PZ Divergence Lite, a very powerful divergence trading support indicator that you can download at