The importance of trade management in trading cannot be overstated. Proper trade management can make the difference between success and failure in the financial markets. Here’s an overview of

1. The Importance of Trade Management in Trading:

- Capital Protection: Trade management ensures that you don’t put too much capital into a single trade, minimizing risk and protecting your investment capital.

- Position Sizing: Trade management helps you determine the appropriate position size for your account and the level of risk you can accept.

- Profit Target Setting: Trade management allows you to set specific profit targets for each trade, helping you have a concrete plan and direction in trading.

- Risk Management: By setting reasonable stop-loss points and using risk management tools like ratio-based stop-loss, you can minimize risk and protect your account from unsuccessful trades.

- Optimizing Risk-Reward Ratio: Trade management helps you determine the ideal risk-reward ratio for each trade, optimizing profit opportunities in relation to risk.

- Controlling Trading Psychology: Trade management helps control your trading psychology, minimizing the influence of emotions like fear and greed, and helping you make decisions based on discipline and analysis.

- Determining Entry and Exit Points: Trade management helps determine reasonable entry and exit points based on technical analysis and market signals, increasing the likelihood of success in trading.

- Strategy Adjustment: Trade management allows you to adjust your trading strategy over time, based on previous trading results and current market conditions.

- Tracking and Evaluation: Trade management helps you track and evaluate your trading performance, thereby drawing lessons and improving trading skills.

- Building Patience and Endurance: Trade management requires patience and endurance, helping you build a sustainable trading mindset and adjust strategies reasonably over the long term.

In summary, trade management is an extremely important factor in trading. It helps protect capital, minimize risk, set profit targets, optimize the risk-reward ratio, control trading psychology, determine entry and exit points, adjust strategies, track and evaluate performance, and build patience and endurance in trading. By applying strict trade management, traders can increase their chances of success and achieve long-term results in the financial markets.

Below, I introduce an EA that helps manage trades in the most excellent way

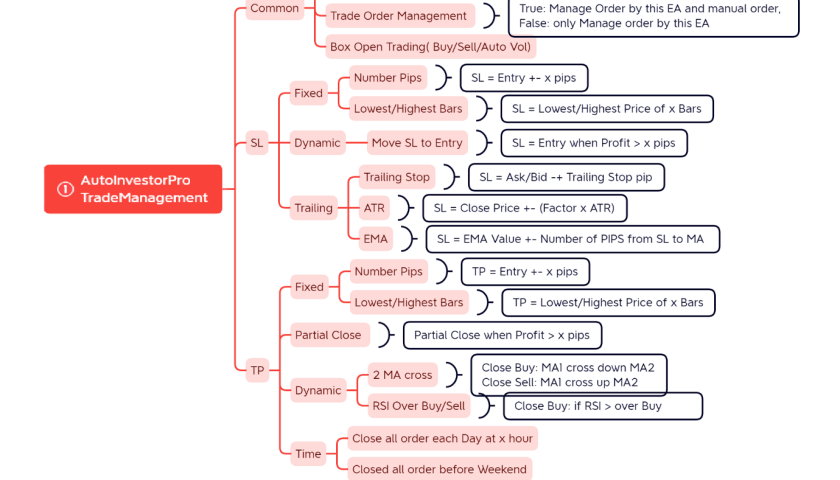

2. Main Functions of Ea TradeManagement

- General Management:

- Manage by Symbol, manual orders and EA orders

- Friendly trade interface, drag and drop Stoploss, Takeprofit, Entry

- Stop-loss Order Management

- Automatically set SL according to fixed Pip number

- Automatically set SL at the highest and lowest price in x candles

- Automatically move SL to entry after x pips

- Automatic trailing Stop after x pips

- Automatic trailing stop by ATR

- Automatic trailing stop by EMA

- TakeProfit Order Management

- Automatically set TP according to fixed pips

- Automatically set TP at the highest and lowest price in x candles

- Automatically close a portion of Volume after profit reaches x pips

- Automatically close order when 2 MA lines cross

- Automatically close order when RSI exceeds Over Buy and Over Sell thresholds

- Automatically close all orders every day at x o’clock

- Automatically close all orders on weekends

3. EA Usage Instructions

EA Installation

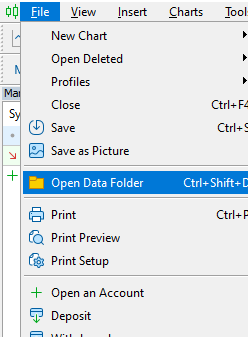

Go to File on MT5 Open Data Folder. Copy the EA to the MQL5/Experts/ directory.

Instructions to Open EA in MT5

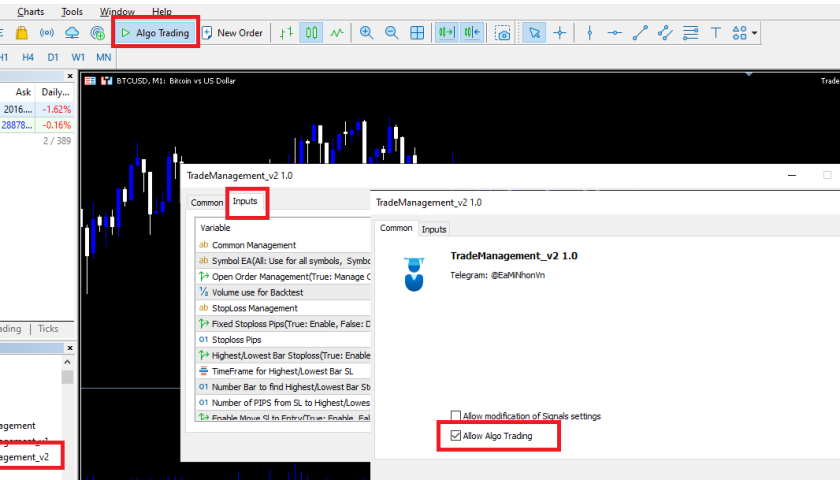

+ Drag the EA to the Chart on MT5

+ In the Common Tab: tick the Allow Algo Trading box

+ In the Inputs Tab: Configure the EA’s input parameters

+ In the MT5 interface: Click on Allow Algo Trading

EA_TradingManagement Management

General Management Interface

Real-Time trading management interface

Backtest running interface

General Management Parameters

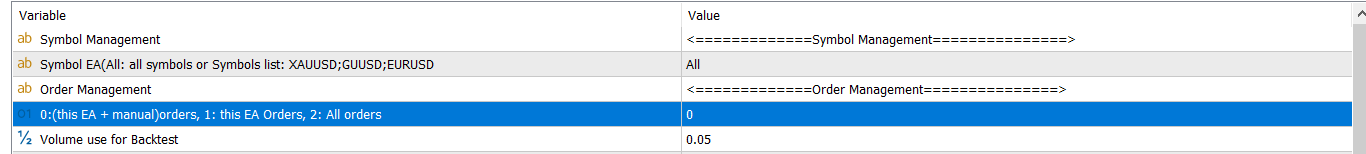

- Order Management by Symbol:

+ All: EA manages all symbol pairs

+ Symbol List: Enter the Symbol pairs to manage, separated by “;” e.g., EURUSD;XAUUSD

- Order Type Management

Order Management:

0: manages Orders from this EA and manually placed orders

1: Manages only Orders from this EA

2: Manages all Order types from this EA + Other EAs + Manually placed Orders

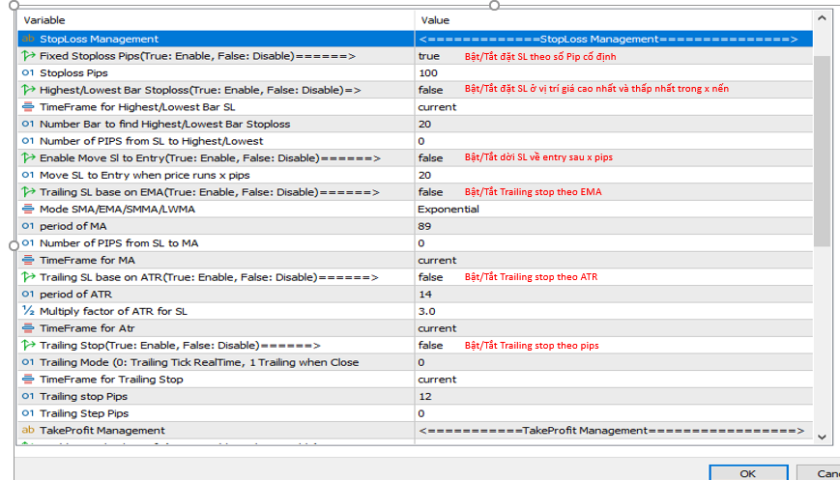

- Stop-loss Management Parameters

+ Fixed Stoploss Pips: Enable/Disable fixed pips SL management

+ Highest/Lowest Bar Stoploss: Enable/Disable SL management based on the highest or lowest price in x bars

+ Enable Move SL to Entry: Enable/Disable automatic SL move to Entry after x pips

+ Trailing SL base on MA: Enable/Disable automatic SL move based on MA line

+ Trailing Sl Base On ATR: Enable/Disable automatic SL move based on ATR

+ Traling Stop: Enable/Disable SL move based on Trailing Stop

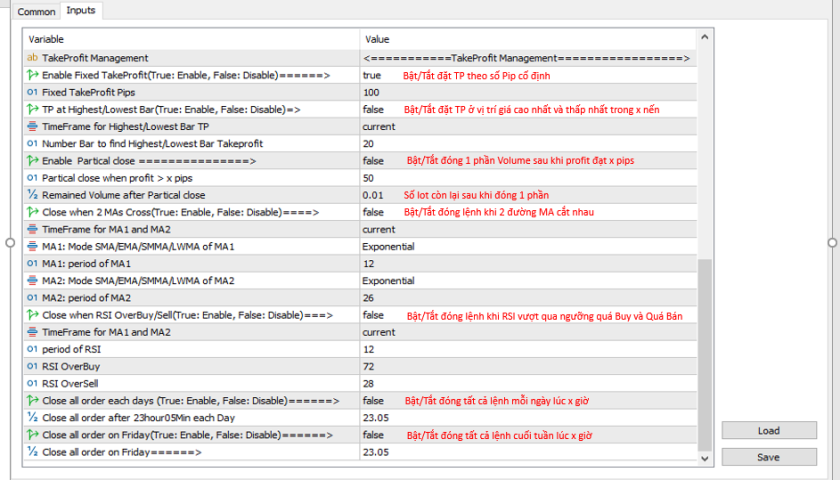

- Takeprofit Management Parameters

+ Enable Fixed TakeProfit: Enable/Disable automatic TP setting (x pips)

+ TP at Highest/Lowest Bar: Enable/Disable automatic TP setting based on the highest or lowest price in x bars

+ Enable Partical Close: Enable/Disable automatic partial order closure when price reaches x pips

+ Close When 2 MA Cross: Enable/Disable automatic order closure when 2 MA lines cross

+ Close When RSI Over Buy/Sell: Enable/Disable automatic order closure when RSI exceeds Over Buy for Buy orders, Close order when RSI exceeds Over Sell for Sell orders

+ Close All Order Each Day: Enable/Disable automatic order closure at x.yy (x hours, YY minutes)

+ Close all order on Friday: Enable/Disable automatic weekend order closure on Friday

Above are all the most necessary features for a trade management EA, you can Download directly below