Scalping strategy helps you take advantage of short-term market fluctuations to achieve profits. Learn how to apply scalping strategies in FX trading and enjoy fast and flexible trading opportunities.

Usage instructions

Trading software: MT4, MT5 or any

Time frame: M5

Trading pairs: Priority for major pairs

Trading hours: European session – US session

Description of scalping strategy

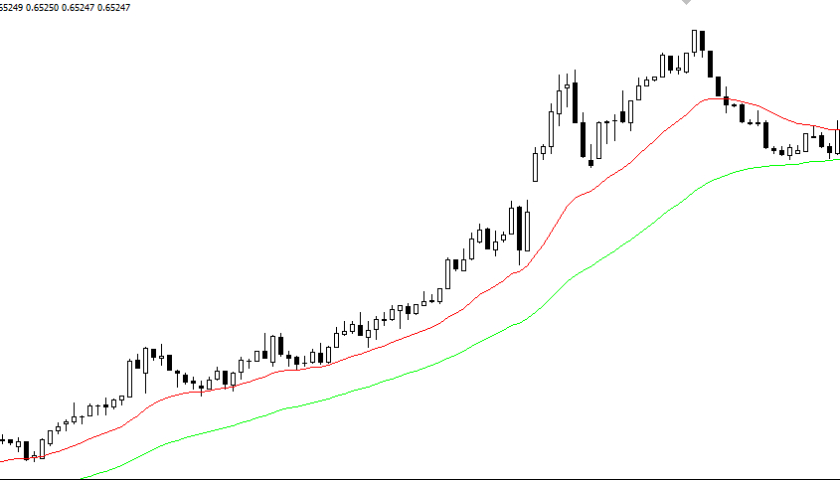

As we know, most indicators are usually slower than signals, to overcome this situation, use two moving averages (MA) only to express market trends. Two MA lines do not intersect or overlap, but move parallel like river flow. They create a “RIVER” area between the two MA lines. In this article, we will guide you on how to use the scalping trading method to trade quickly and effectively on the Forex market.

Conversely, if a disturbance occurs, the lines intersect, showing no clear direction, it is a non-trending market.

Trading rules

On the M5 time frame, you need to use 2 MA lines (EMA 20 and EMA 50). If these two lines do not intersect and go in the same direction (up or down), it gives us a very intuitive image, looking like a peaceful river (the market is trending).

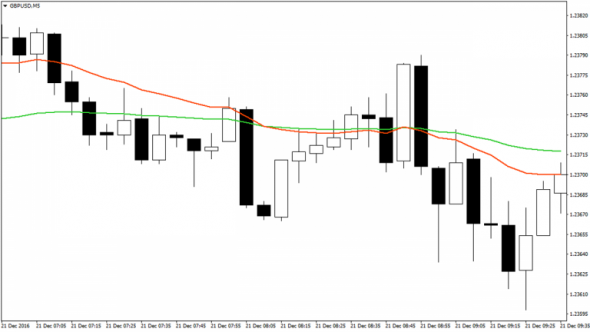

When the market is trending, with a corrective wave, the price should not stay too long on this river, meaning there should not be more than 3 candles closing in the area between the 2 MA lines. If there are 4 or more candles closing in this area, we ignore that trading signal. The example below shows that there are up to 6 candles closing in the river area, at this time the trend has weakened, so we do not trade with this signal.

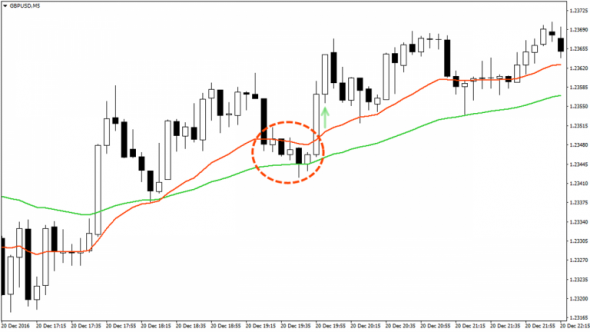

After 3 candles close in the river, the next candle closes below MA20. We will trade at this closing candle position.

The Stoploss (SL) position is above the top of the candles in the river and the TakeProfit level will be at 2 levels. To do this, we will open 2 orders (same lot and same SL). Details are as follows:

- Order 1: has TP equal to the number of pips SL (Risk = 1:1)

- Order 2: TP level will move according to the created top/bottom.

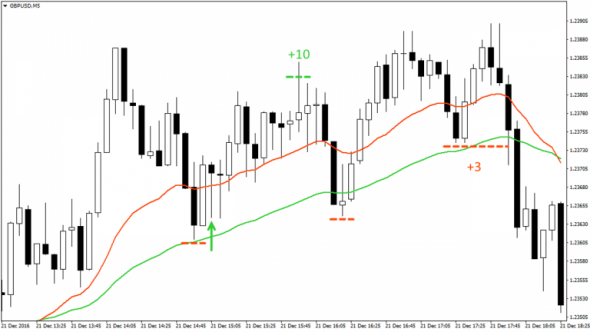

An example of an uptrend. The price closes below the MA20 line and the next candle then bounces up and closes above the MA20 line. When the candle closes, we enter a BUY order (2 BUY orders). Place SL below the bottom of the candle with the closing price below MA20.

BUY order 1: profit + 10 pips

BUY order 2: move SL according to the newly formed bottom and unfortunately hit SL too early (+3 pips)

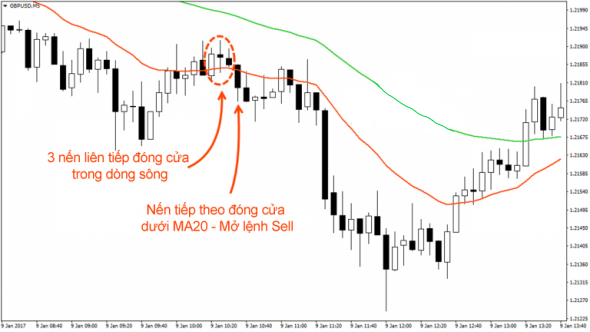

Instructions for determining the main wave and corrective wave in a downtrend

In the downtrend example, determining the main wave and corrective wave is very important. First, the main wave appears strongly, followed by a weak corrective wave.

Entry position 1: Clear main wave and corrective wave, sell order according to the main wave brings good profit.

Entry position 2: Selling pressure decreases, a change from a stable to unstable market appears.

Entry position 3: This position needs to be considered when trading, because selling pressure has decreased significantly.

Capital Management

an important factor that cannot be ignored is capital and risk management. With a trading system, capital management should be carried out with a bet of 1-2% per trade and a minimum Risk/Reward ratio of 1:1.

Conclusion

This scalping trading system has a simple but effective strategy. However, we need to note one important thing: do not trade when the price is in the river for a long time. The maximum acceptable limit is 3 consecutive closing candles.

In addition, wave analysis based on price action will help you accumulate experience and choose better trading opportunities, while minimizing risks.

Focus on observing and choosing “beautiful” rivers to increase profit opportunities for your account.

Wishing you successful trading!

Source: Maxi

Additionally, you can explore other forex trading support tools at: https://autoinvestorpro.com/category/mt4-mt5-tools/